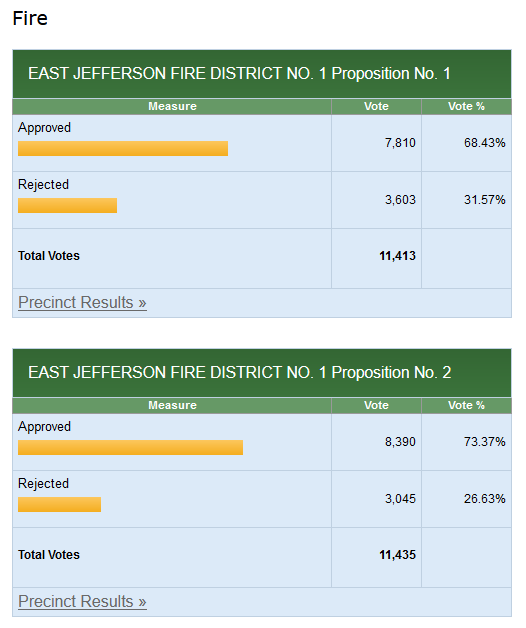

Thank you to our community for all the support in the recent February levy lid lifts! Because of you we can continue to maintain and enhance our Fire and EMS services. We are proud to serve the community and grateful for your ongoing support!

Town Hall Meetings took place January 18, 19 & 26 2023:

On December 13, 2022 EJFR’s Board of Commissioners voted to put two measures on the February 2023 Ballot.

22-12 EMSLevyLidLiftSingleYearPermanent

22-13 LevyLidLiftSingleYearPermanent

Levy Lid Lift FAQ’s

How is EJFR (Fire District 1) funded?

Most of the Fire District’s revenue comes from local taxes. The tax levy rate for Fire Districts cannot be increased without voter approval by more than 1% per year even if the assessed real estate value increases. The Fire District has not requested voter approval to increase taxes by more than 1% since the last levy lift in 2011.

How have service demands changed since the last levy lift?

911 demand has increased by almost 50% since the last levy lift in 2011. We experience multiple, simultaneous 911 incidents more than 30% of the time. Occasionally all 911 units are committed, leaving no additional 911 capacity. Our strategic plan recommends more resources, including personnel and equipment enhancements to meet the current and future 911 needs.

Why is Proposition 1 needed?

The Fire District’s 2023 General Fire Budget has an estimated $462,177 short fall. This ballot measure will raise the Fire – General tax rate to $1.30 per $1000 of assessed value. The current rate is approximately $.85. The additional revenue will be used for Fire, Rescue and EMS services as recommended in our strategic plan to help address the increased service demands.

Why is Proposition 2 needed?

The Fire District’s 2023 Emergency Medical Services (EMS) budget has an estimated $1,843,027 short fall. This ballot measure will help close the revenue gap and restore the Emergency Medical Services (EMS) tax rate to its maximum, $.50 per $1000 of assessed value. The current rate is $.36. EMS incidents comprise 75% of our responses. The additional revenue is needed to maintain and enhance EMS services.

Why are EJFR expenditures exceeding revenue?

Years of inflation have raised property values, which reduces the Fire District’s tax levy rate due to the 1% annual cap. The Fire District cannot raise the 1% cap without voter approval, which was last approved in 2011. EJFR has to use reserve/contingency funds to maintain services which is not sustainable. Propositions 1 and 2 will reset levy rates allowing the District to stop deficit spending and begin replacement of equipment, restoration of mandated training and hire additional personnel as recommended in our strategic plan.

How much will this cost me?

Using the latest estimates provided by the Jefferson County Assessor’s Office, for a home valued at $350,000, the home owner would experience an approximate annual tax increase of $157.50 for Proposition 1 – Fire Levy. Proposition 2 – EMS Levy would result in approximately $49.00 annual increase. If both initiatives were approved by the voters, the fire district tax levy increase would result in a $206.50 annual increase for the $350,000 valued home.

Didn’t the merger with Port Ludlow solve the revenue gap for both Fire Districts?

Throughout the temporary management agreement and subsequent merger initiative, the budget challenges for both fire districts were shared with the respective communities, commissioners and public. To address the shortfall, the scoping document developed by the Districts proposed two steps: become a combined fire district that is as efficient as possible and post-merger, prepare a levy lid lift. The merger eliminated the Fire Chief and Assistant Fire Chief for Port Ludlow and increased daily minimum staffing for both agencies. We are in the process of streamlining various contracts, services and duplicated services. The Fire District needs additional financial resources in order to improve services and meet the objectives established in the strategic plan.