East Jefferson Fire Rescue (EJFR) would like to express our tremendous gratitude for the community support and overwhelming approval of Proposition 1 and Proposition 2.

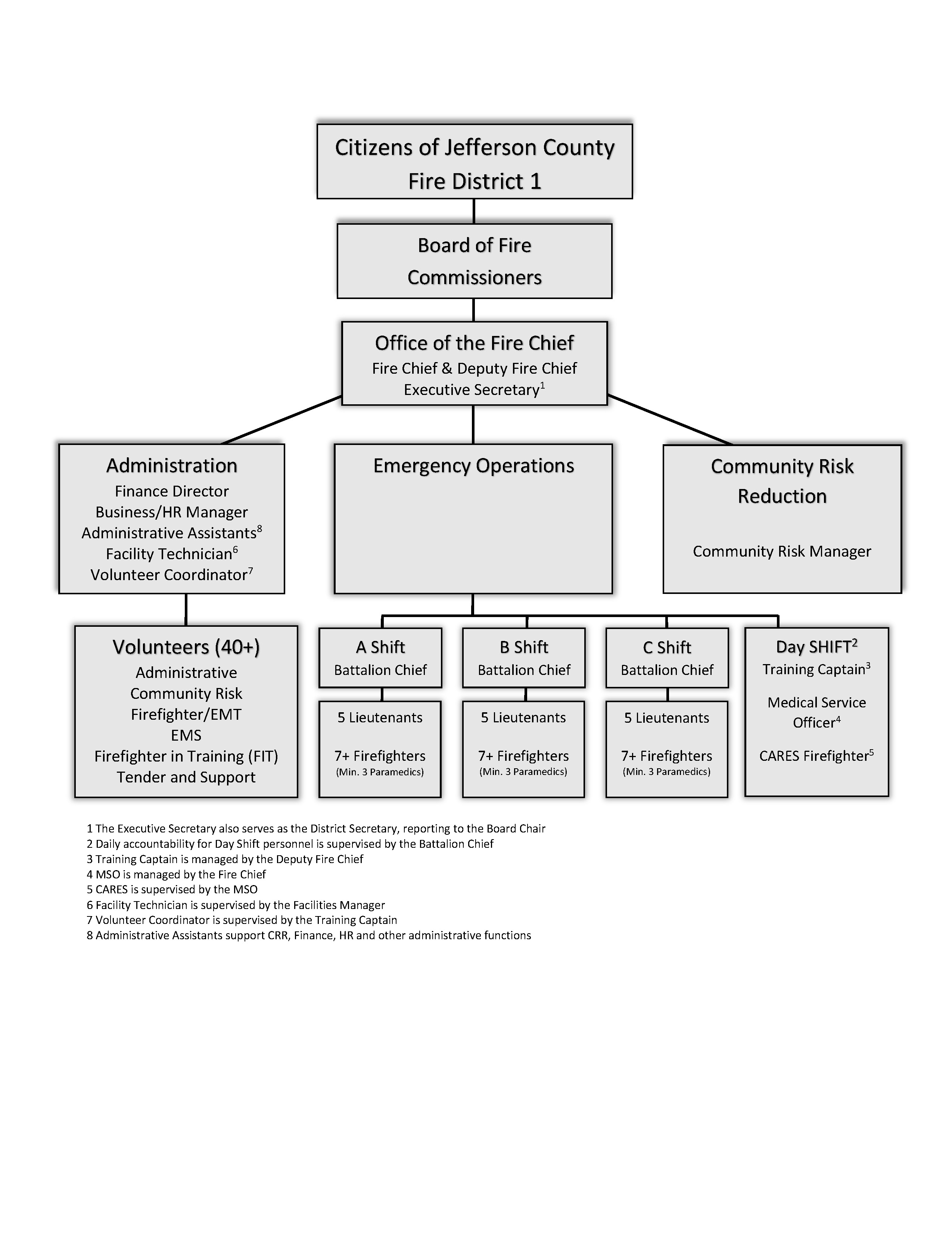

Our dedicated career firefighting and administrative professionals and our cadre of volunteers work together every day to support the health and welfare of this community.

As fire districts, we ask our residents to reset levy rates every few years, allowing us to continue a community conversation about the services that we provide. Through our Know Your Fire District town hall meetings, we heard countless stories of how important a high level of emergency services is to the community and how your continued support allows us to fund those efforts. Throughout the year, EJFR focuses on maintaining a record of fiscal responsibility and transparency into the operations and finances of the district.

Your trust and confidence in the mission and leadership of EJFR will allow us to:

- Provide our exceptional firefighters with sufficient staffing, innovative training, and reliable equipment to meet the expanding emergency response needs of the community.

- Foster further development and training of our generous volunteers who give their time in service throughout the year.

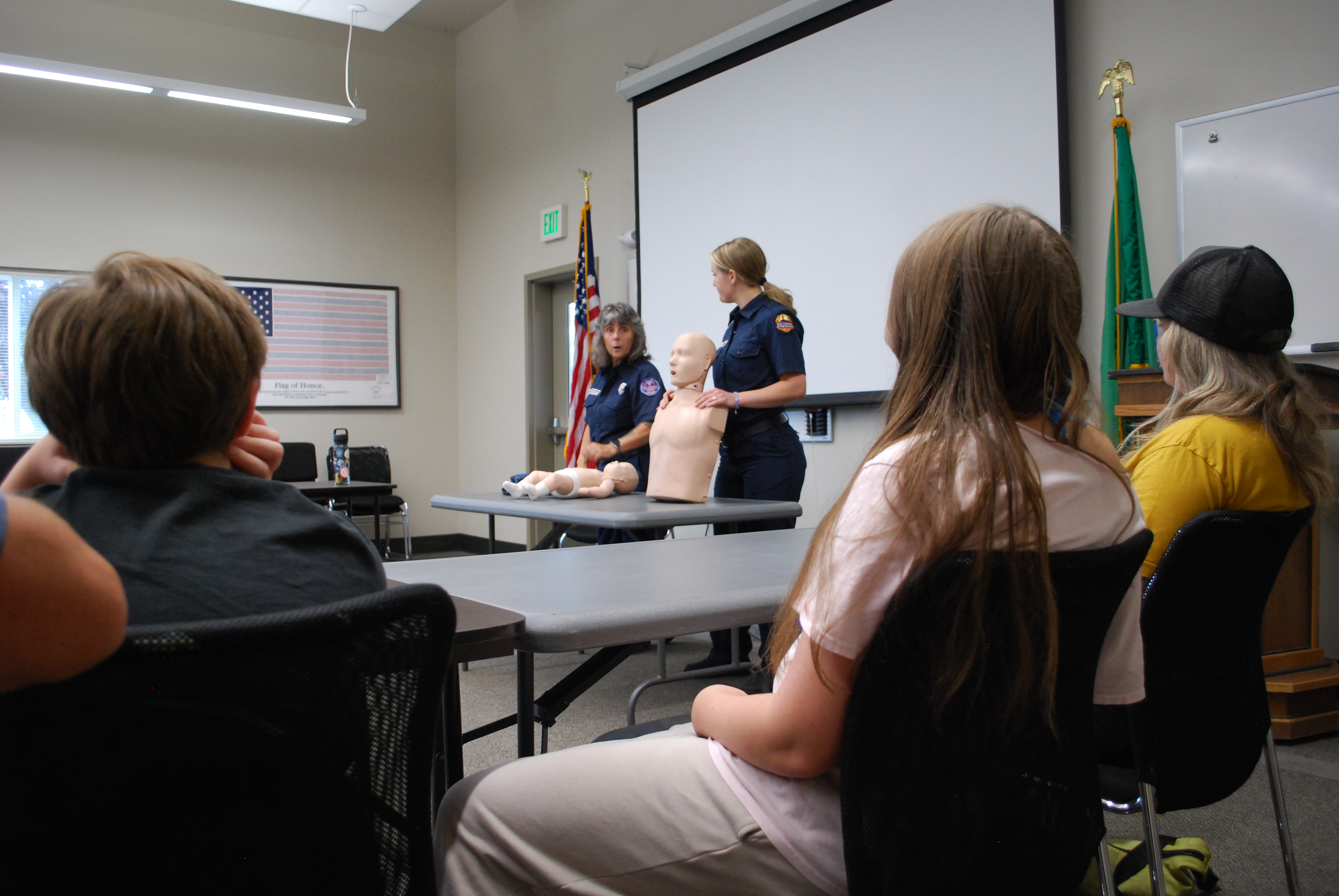

- Expand and enhance our fire prevention programming to address the emerging risks we face, including expansion of public education, CPR training, smoke alarm installations, fire extinguisher training, and home wildfire assessments.

- Keep meeting the ongoing medical and social needs that our CARES team provides throughout the district.

As we move forward, we will continue to provide transparency and clear communication in our role as a vital community partner. Service to this community is an honor that we hold dear.

On behalf of the 118 members of East Jefferson Fire Rescue, thank you, and we are here for you when you need us.

A series of townhall meetings have been held around the district to discuss factual and objective details related to EJFR with opportunities for feedback and questions. Topics included: State of the Fire District, Accomplishments/Challenges, 2026 Budget, and the Levy Ballot Measure.

To request EJFR to speak to your community group call (360) 385-2626.

EJFR Commissioners place measures on February ballot

At the November 18th meeting, the EJFR Board of Fire Commissioners unanimously approved resolutions to place Proposition 1 Fire Levy Lid Lift and Proposition 2 Emergency Medical Service Levy Lid Lift on the February 10, 2026 ballot.

Resolution 25-15 Proposition 1 Fire Levy

Proposition 1 will restore the Fire Levy to $1.40 per $1000 of property valuation.

Resolution 25-16 Proposition 2 EMS Levy

Proposition 2 will restore the EMS Levy to $0.50 per $1000 of property valuation.

Frequently Asked Questions

How is EJFR funded?

More than 80% of EJFR’s annual budget is funded by local property taxes. However, state law limits property tax revenue growth for fire districts to 1% per year, regardless of increases in assessed property values. At the same time, the actual cost of providing fire and EMS services rises at least around the rate of inflation, typically 3%-4% per year. Operational expenses including personnel, equipment, training, and facilities increase yearly, well beyond this 1% limit, making it increasingly difficult to sustain a high level of service to the community. Resetting these levy rates is part of a broader, responsible financial strategy, but cannot be done without voter approval.

How much will this cost the average property?

It is important to know that these are not new property tax levies, they are resetting the rates for property tax levies that are already being assessed.

For 2026, the Fire levy rate is being assessed at $1.21 per $1,000 of assessed value and $0.47 per $1,000 for EMS. Due to the 1% state mandated cap, the projected levy rates in 2027 will lower to $1.19 per $1000 for Fire and $0.46 per $1,000 for EMS.

If these measures are approved, the 2027 rates would reset to $1.40 per $1,000 for Fire and $0.50 per $1,000 for EMS. This equals a cumulative increase of $0.25 per $1,000 of assessed value.

Working with the Jefferson County Assessor’s Office, EJFR estimates a property with an assessed value of $600,000 will see an approximate annual tax increase of $150.00 if both initiatives were approved by the voters. For homes with assessed value of $350,000, an approximate annual tax increase of $87.50 if both initiatives are approved.

How has EJFR improved over the past few years?

EJFR now staffs five stations across the 123 square mile district with 13 firefighters on duty each day (up from 7 per day), at least three of those firefighters are paramedics, providing advanced medical care. We have added new ALS equipment, cardiac monitors, power cots, and ultrasounds placing EJFR’s EMS care on par with larger, well-funded fire departments in urban areas. New and expanded programs to reduce and mitigate emergency responses include our CARES unit, home wildfire assessments, smoke detector installations, fire extinguisher classes, and more.

What is CARES?

Community Assistance Referral and Education Services. CARES made 1500+ contacts last year, helping to connect our most vulnerable population to resources and services. CARES provides medical referrals, prescriptions coordination, food/housing support, counseling, medical equipment, grab bars, etc.

Will firefighter salaries be directly impacted by the levy?

As public employees, our firefighters are compensated by contract; the current contract term is established through 2027. The district strives to stay within our means. But at the same time, it would be detrimental to have our salaries not keep up when people are looking for other opportunities outside of the organization, which has happened several times in the past. Remaining competitive in the firefighter job market is a continuing challenge as larger urban and suburban fire departments offer signing bonuses and other incentives that exceed EJFR’s financial capacity.

Who do I contact with questions?